COMPANY-CENTRIC

DESIGN: "THE COMPANY" CONTROLS CFPB COMPLAINT ARBRITRATION PROCESS, AND

CFPB TAKES NO ACTIVE ROLE IN THE CONSUMER COMPLAINT RESOLUTION PROCESS!

THE CFPB COMPLAINT PROCESS IS THE GREATEST

COMPLAINT-RESOLUTION FRAUD EVER PERPETRATED UPON THE AMERICAN CONSUMER,

BECAUSE CONTRARY TO THE GRANDIOSE, OUTRAGEOUS CLAIMS ON ITS WEBSITE, AS

BEING THE "CHAMPION OF THE CONSUMER", CFPB ALWAYS RUBBER-STAMPS "THE

COMPANY" BIASED-ARBITRATION RESPONSES; AND THUS, "THE COMPANY"ALWAYS

WINS!

CFPB PLAYS

NO ROLE IN THE COMPLAINT ADJUTICATION PROCESS:

"THE

COMPANY" IS THE JUDGE, jURY, AND EXECUTIONER!

FINANCIAL SERVICES INSTITUTIONS,

NATIONAL BANKS, and others ARE CURRENTLY LOBBYING FOR THE SHUTDOWN OF

THE CFPB COMPLAINT SYSTEM, BUT THEY DO NOT REALIZE THAT "THEy" WINS MORE

THAN EIGHTY PERCENT OF THE COMPLAINTS FILED BY CONSUMERS; AND THAT CFPB,

RUBBER-STAMP'S "theIR" response more than ninety-three percent of the

time! "THE COMPANY" CURRENTLY HOLDS ALL THE CARDS, AND ARE THE

PROVERBIAL: "JUDGE, jURY, AND EXECUTIONER" OF COMPLAINTS RECEIVED VIA

THE CFPB COMPLAINT PROCESS.

Current Initiatives by some large financial services companies, and national

banks to weaken (or even abolish) the CFPB Consumer Complaint process, is the classic example of:

"Killing the Golden Goose"; because as of April 2017, the more than seven hundred and

forty-three thousand consumer complaints contained in the CFPB Complaint Database,

shows that: "THE COMPANY ALWAYS

WIN!" Some of the many

glaring examples that corroborate this hypothesis, include:

- The CFPB Complaint Process

includes an stealthy, backdoor "COMPANY PORTAL" by which it connects to more

than four thousand companies. This portal is not mentioned

in any consumer-related documentation, but it is the

underpinning of the CFPB Complaint arbitration process. The

"portal" is a web-based, interactive information channel

between CFPB and "The Company"; and

- Although, the CFPB

Complaint Process documentation still includes terms such as

"sending CFBP complaints to The Company", or uploading

complaint data to "the Company"; the reality is, that

all of the more than forty-two hundred registered companies, have instantaneous access to CFPB

Complaint data residing in the Company Portal, and;

-

This "portal" provides the "The Company" with

instant, real-time access to all CFPB complaints filed by

all consumers, so it can used the "canned" arbitration

responses that it previously used for simular complaints,

and;

-

These companies

are solely responsible for the arbitrating and

closing all consumer complaints they received via Company

Portal, and;

- CFPB

"Rubber-Stamped" the Company responses, more than 93% of the time,

and;

- more seventy-three percent of all

consumer complaints are "Closed with Explanation",

by the Company; with no

"Monetary Relief" for the consumer, and;

- annual ranking of Companies based

upon the number of complaints received, percentage of

complaints "Closed with Explanation", and percentage of

complaints "Closed with Monetary Relief', are not shared by

CFPB, and;

- more than ninety percent of

the Company responses to consumer complaints are

not publicly

shared, and this allows many

the Company to reject, and

"Close without explanation", more than ninety percent of all

CFPB consumer complaints received, without drawing the

attention of other federal or state consumer protection/consumer

complaint agencies, and;

- there is no dispute or escalation

procedure available to consumers who disagree with the

response received from the

Company, and;

- For all intentional purposes, consumers who filed complaints

with CFPB, and had their complaints

rejected and closed by the Company;

inadvertently-eliminates

all future options of filing the same complaint with CFPB, or other

federal, state, or local consumer protection/consumer

complaint agencies, and;

- The CFPB "Stamp of Approval" of

the

Company response, can be referenced by

the Company, in

its

responses to future CFPB complaints from the same consumer

(or other consumers), and, finally;

- Other federal consumer complaint

agencies, such as the Consumer Assistance Group (CAG) of the

Office of the Comptroller of the Currency (OCC), still

continue to refer consumer complaints

(i.e., "Blindly throw consumer

complaints over-the-wall") to CFPB, even though

they have been alerted again, and again, and again.

- Click

HERE

view more details regarding the Company-Centric CFPB

Complaint Process.

The

CFPB's: "The Company is Always Right Approach", to resolving

consumer complaints, is an overt, blatant contradiction to CFPB

fiduciary responsibility as defined in the Dodd-Frank Wall

Street Reform, and Consumer Protection Act of 2010. This Act

empowered CFPB with the responsibility to ensure that

financial-related consumer complaints,

filed by American consumer, were arbitrated in a fair, and

impartial basis.

|

"THE COMPANY ALWAYS WINS!"

THE CFPB COMPLAINT DATABASE SHOWS THAT

The ratio of Consumer Complaints "Closed with

Explanation" versus Consumer Complaints "Closed with Monetary Relief"

is more than 10:1 for all COMPLAINTS; AND AS HIGH AS 30:1 FOR

MORTGAGE-RELATED COMPLAINTS.

During the period in question from between

January 2012 and April 2017, the CFPB Complaint Database shows

that:

|

As incredible as the above "Closed with

Explanation" responses from Companies are; the "Closed with

Explanation" responses for Mortgage complaints are even higher:

-

157,316 (89.42%)

of the

175,934 consumer mortgage complaints were

"Closed with Explanation" by the

Company,

and;

-

4,952 (2.81%) of the 175,934 consumer mortgage complaints were

"Closed with Monetary Relief" by

the Company.

-

This is

a 31:1 ratio of Closed with Explanation versus Closed with

Monetary Relief responses from the Company. (Click

HERE for additional Top-10 mortgage complaint

statistics.)

|

Additionally, between January 2012 and

April 2017, consumer disputed 145,150 (19.5%) of the 743,427

responses received from the Company; and apparently, none of

these complaints resulted in further actions upon the

consumers' behalf by CFPB. (It is important to note; that the CFPB Freedom

of Information Act (FOIA) Office disclosed that CFPB referred 21,198

consumer complaints to other agencies during the period in question;

however, because these referrals were not tracked in the CFPB Database,

it is unclear if these referrals were based upon consumer complaints, or

CFPB actions. (A summary of these CFPB Referral can be viewed

HERE.)

|

Other

Major Problems Found in Flawed-CFPB Complaint Process

Some of the most glaring problems we found within the CFPB

Complaint Process include:

-

Companies are allowed to

arbitrarily close complaints even though consumers

have formally disputed the Company Response. In most

instances, the consumer's disputes include

additional documentation that further authenticates

and/or strengthen their original complaint. Between

2011 and March 26, 2017, consumers disputed more

than one hundred and forty-five thousand Company

responses, and there are no records in the CFPB

Complaint Database that any of these disputes were

ever reviewed by CFPB Reviewers, before being

discarded. (Click HERE to see a list of all consumer

complaint disputes by Company, by year.)

-

The Company is allowed to specify whether, or not;

its response to a consumer can be shared publicly;

and if they choose to not share this information,

consumers have no awareness of similar complaints

filed by other consumers.(More than ninety-three

percent of all Company responses, were not shared

publicly. See table below entitled: "Company

Responses Sent to CFPB and Consumers, but not Shared

Publicly", to see annual percentages of Company

responses not shared publicly. (When Companies do

not share their responses to consumer complaints

publicly, it is virtually-impossible for consumer

protection agencies to track and analyze patterns of

potentially-fraudulent and/or criminal behavior by

Companies.)

-

Complaints referred by other consumer complaint

agencies, do not receive any special treatment, even

though they have already been reviewed before being

referred to CFPB; additionally, it does not appear

that the Company is made aware of the fact that

these complaints were review by another agency

before being referred to CFPB. Finally, when the

Company closes the complaint, the response by the

Company, is not forwarded to the referring consumer

complaint agency, and if another consumer files an

identical complaint, there is no ability of the

referring agency to inform this consumer of the

results of the prior complaint(s).

-

The CFPB Consumer Complaint Database includes

ninety-five issues, which can be used by consumers

to file complaints with more than forty-one hundred

companies; however, all of these issues appear to be

given the same CFPB ranking and/or priority. As this

implies, all of these ninety-five issues are treated

equally, in the CFPB complaint process; for example,

it appears that a five-hundred dollar pay-day loan

complaint is treated the same as a five-hundred

thousand dollar home mortgage loan complaint. (Click

HERE to see a list of all CFPB complaint issues.).

-

Complaints alleging

serious, and possibly felonious, violations of

federal and state laws are apparently handled the

same as all other consumer complaints, and

theoretically, there could be dozens, if not

hundreds, of similar complaints against a Company; and CFPB would

never refer any of these alleged criminal activities

to its internal enforcement unit, or to other law

enforcement agencies.(Click

HERE

to view all CFPB Consumer Complaint actions for

these Identity theft, Fraud, and Embezzlement

complaints.)

-

Click

HERE

to see the top-twenty reasons why the CFPB

Complaint Process does not work.

|

When a consumer Files A

COMPLAINT via the CFPB complaint process, it is frequently THE

PROVERBIAL "THE KISS OF DEATH" for not only that COMPLAINT; but

it virtually eliminates the probability that similar complaints

from other consumers will receive a fair and objective

arbitration!

Filing a consumer complaint against a Company

with CFPB, (or other federal agencies that, frequently and

unceremoniously, "throw consumer complaints over the wall" to CFPB), is

the proverbial "Kiss of Death" to the complaint. As the following

Mortgage Complaint table shows, in the vast majority of instances, the

Company simply rejects the consumer complaint, and sends a "Closed with

Explanation Response to CFPB; and then the Company is virtually-immune

to any future CFPB-related actions from the consumer. Furthermore, the

Company can explicitly-request that its response to this complaint not

be shared publicly, and then used the CFPB-approved "Closed with

Explanation" response, to respond to dozens, or even hundreds of

identical (or similar) complaints from other consumers. The fact that

the Company chose not to share these responses publicly, means that

consumers, and other consumer complaint/consumer protection agencies,

have no awareness of the fact that a given consumer complaint was

previously-filed with the CFPB dozens, in some cases hundred, of times.

WIDE VARIATION IN "THE COMPANY"

RESPONSE SENT TO THE CONSUMER

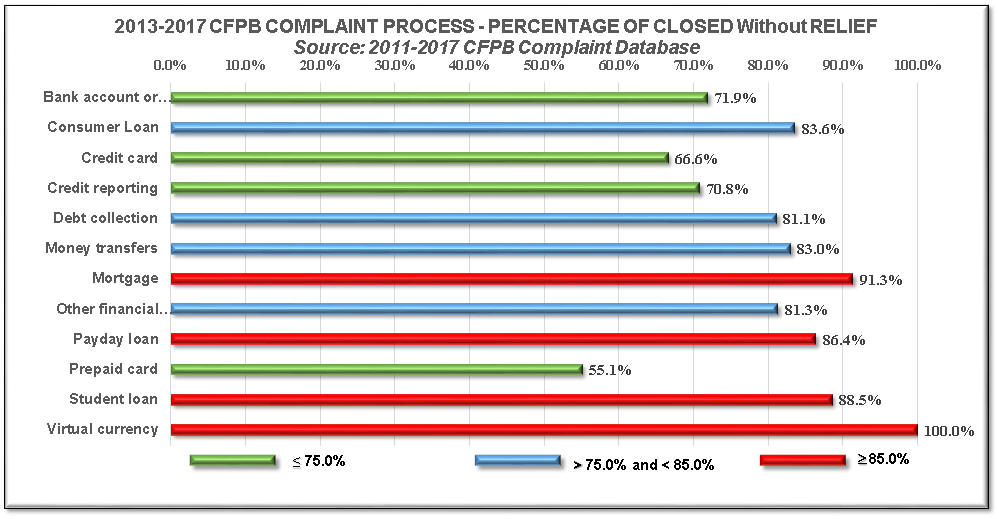

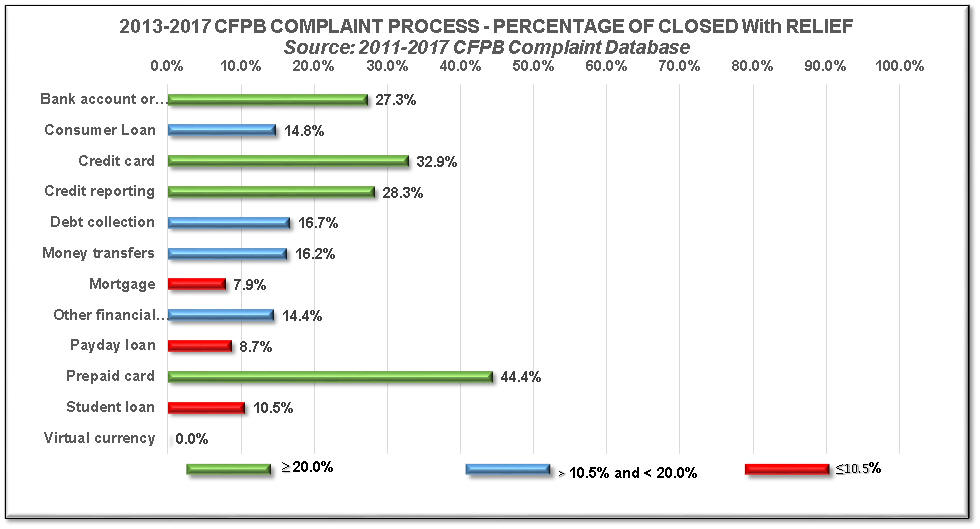

As of April 2017, the CFPB Complaint

Database included 743,427 consumer complaint records, and 668,485 of

these records were created during the period from January 1, 2013

through March 2017. The two tables below charts below show wide

variation of how companies responded to the twelve products that

were tracked by the CFPB Complaint Process during this period:

2013-2017 CFPB COMPLAINT PROCESS -

TWELVE PRODUCTS

(Including Closed with no Relief,

and Closed with Relief Responses from "The Company".) |

|

Product |

Closed |

Closed with explanation |

Closed with monetary relief |

Closed with non-monetary relief |

In

progress |

Untimely response |

Total Complaints |

Percentage Closed wo/Relief |

Percentage Closed w/Relief |

|

Bank account or service |

1953 |

49479 |

15043 |

4518 |

467 |

100 |

71560 |

71.9% |

27.3% |

|

Consumer Loan |

558 |

23105 |

1827 |

2352 |

236 |

233 |

28311 |

83.6% |

14.8% |

|

Credit card |

487 |

46137 |

15152 |

7881 |

298 |

60 |

70015 |

66.6% |

32.9% |

|

Credit reporting |

401 |

93338 |

702 |

36730 |

1200 |

33 |

132404 |

70.8% |

28.3% |

|

Debt collection |

6937 |

106561 |

1839 |

21519 |

544 |

2528 |

139928 |

81.1% |

16.7% |

|

Money transfers |

61 |

4233 |

633 |

207 |

19 |

21 |

5174 |

83.0% |

16.2% |

|

Mortgage |

4686 |

163142 |

5191 |

9334 |

1048 |

330 |

183731 |

91.3% |

7.9% |

|

Other financial service |

38 |

757 |

104 |

37 |

7 |

35 |

978 |

81.3% |

14.4% |

|

Payday loan |

193 |

4429 |

261 |

206 |

6 |

255 |

5350 |

86.4% |

8.7% |

|

Prepaid card |

40 |

1969 |

1133 |

488 |

16 |

1 |

3647 |

55.1% |

44.4% |

|

Student loan |

169 |

24066 |

1138 |

1745 |

196 |

56 |

27370 |

88.5% |

10.5% |

|

Virtual currency |

1 |

16 |

|

|

|

|

17 |

100.0% |

0.0% |

|

Total Complaints |

15524 |

517232 |

43023 |

85017 |

4037 |

3652 |

668485 |

79.7% |

19.2% |

Source: 2011-2017 CFPB Complaint Database

"THE COMPANY" RESPONSES: CLOSED

AND CLOSED WITH EXPLANATION VERSUS CLOSED WITH MONETARY

RELIEF AND CLOSED WITH NO MONETARY RELIEF.

The following charts show

the:

- Closed and Closed with explanation, and;

- Closed with monetary relief and Closed with non-monetary

relief.

|

|

Illustrative Example:

Responses to Complaints against All Mortgage Companies |

|

Closed Response |

Year Complaint Filed |

Total Complaints |

Percent Complaints |

| 2013 |

2014 |

2015 |

2016 |

|

Closed |

1569 |

952 |

1177 |

882 |

4580 |

2.60% |

|

Closed with explanation |

42723 |

39286 |

37685 |

37622 |

157316 |

89.42% |

|

Closed with monetary relief |

1323 |

1050 |

1300 |

1279 |

4952 |

2.81% |

|

Closed with non-monetary relief |

3760 |

1633 |

2122 |

1571 |

9086 |

5.16% |

|

Grand Total |

49375 |

42921 |

42284 |

41354 |

175934 |

100.00% |

|

Source: CFPB Consumer Complaint Database

at:http://www.consumerfinance.gov/data-research/consumer-complaint |

| Although the almost ninety percent

"Close with explanation" response rate for all mortgage

companies is outrageous; "Close with explanation" responses from

other Top-10 Mortgage Companies are as high as 98.57%. Click

HERE to see more Close with explanation

responses from the Top-10 Mortgage Companies.. |

| REGARDLESS OF THE METHOD USED BY

CONSUMERS TO FILE COMPLAINTS VIA "THE FLAWED-CFPB COMPLAINT

PROCESS"; THE RESULTS ARE ALWAYS THE SAME, "The Company

"THE COMPANY ALWAYS

WIN!"

|

During much of the Twentieth Century, there was a long-accepted axiom

that "The Customer Is Always Right"; and while this adage usually

applied to customer complaints, and was most prevalent within segments

the retail industry; many other industry-segments, including the

financial services and mortgage lending industries, adopted this

"golden-rule" as a core business principle. From the consumer's

prospective, this changed within the mortgage industry during the

previous decade, when this industry was inundated by hordes of new

predatory subprime lending institutions. In this new hyper-competitive

environment, even large financial services corporations, and National

Banks were "forced to bend the rules" in order to remain competitive.

The CFPB Consumer Database, used to create this "Consumers for

Consumers" website, vividly illustrates that "The Customer Is Always

Right" has been supplanted by a new axiom that "The Company Always

Wins". From January 1, 2012 through March 26, 2017, the CFPB

Complaint Database shows that 743,427 consumer complaints were submitted

to the CFPB Complaint Process. The origin of these consumer complaints

were:

- Email:

- Fax:

- Phone:

- Postal Mail:

- Referral from other agencies:

- Web:

|

348

10,619

51,038

47,329

130,671

503,422

|

|

The six-year history of the more than forty-one hundred companies to

which CFPB filed consumer complaints can be viewed:

HERE, and the

companies' responses to these consumer complaints viewed

HERE.

The Collaboration BETWEEN CFPB, AND other federal

Consumer Complaint Agencies VIA THE CFPB CONSUMER COMPLAINT PROCESS FACADE.

An analysis of the 2011 through 2017 consumer complaint

contained in the CFPB Complaint Database show that some Consumer Complaint Agencies, Consumer Protection Agencies, and

even Civil

Rights Agencies, are not Fulfilling their Fiduciary Responsibilities to

American Citizens, by Indiscriminately throwing Consumer Complaints

"Over The Wall" to a Defective-CFPB Consumer Complaint Process.

| In many instances, consumer complaints are "Blindly Thrown Over

the Wall to CFPB"; even though the CFPB Complaint Database

shows that the so-called CFPB Complaint Process allowed Companies

to prevail in more than Eighty Percent of all complaints filed

between 2011 and 2017. |

In 2012, during its first full year

of operation, CFPB received slightly over seventy-two thousand consumer

complaints; and the annual number of complaints received by CFPB has

steadily increased, to the point where there were more than one hundred

and ninety-one thousand consumer complaints processed in 2016. As this

rapidly increasing number of CFPB complaints illustrates, consumers have

become increasingly dissatisfied, and more cynical of the quality and

fairness of the financial products and services that they are being

offered; and are registering their displeasure, by filing complaints

with federal, state, and local consumer complaint agencies. However, the

spectacular successes claimed by CFPB have resulted in a "LET CFPB DO

IT" approach to resolving consumer complaints, and today, federal,

state, and local consumer protection agencies rarely pursue complaints

and/or claims against Companies, and virtually all federal consumer

complaints are thrown over the wall to CFPB. Our analysis of the Top-10

Companies to which CFPB filed consumer complaints shows that:

- The Top-20 Companies accounted for 94,428 of the total

130,671 referred complaints for all Companies, and;

- 15,935 of the responses to consumer complaints referred

to these Top-20 Companies were disputed by consumers. (Paradoxically, in May 2017, CFPB admitted that these

so-called consumer complaint disputes, were only used for

Consumer Feedback purposes, and played no role in the

consumer complaint process.)

|

Annual consumer complaint analysis of Top-20

Companies are shown in a series of tables below. Additionally, complaint

analysis summaries of: the

Top-10 Companies can be found

HERE;

and the Top-10 Mortgage Companies, by clicking

HERE.

NO Discrimination-related Complaints

are INCLUDED IN THE CFPB COMPLAINT DATABASE, AND ARE not supported BY CFPB Complaint Process!

CFPB WORK INCLUDE:

q

Rooting out unfair, deceptive, or

abusive acts or practices by writing rules, supervising companies,

and enforcing the law.

q

Enforcing laws that outlaw

discrimination in consumer finance.*

q

Taking consumer complaints*.

q

Enhancing financial education.

q

Researching the consumer

experience of using financial products.

q

Monitoring financial markets for

new risks to consumers.

*

Primary responsibilities of CFPB Complaint Process.

Although, one of the key drivers behind the Dodd-Frank Wall Street

Reform and Consumer Protection Act was to provide a fair, and equal

playing field upon which all consumers would have access to Fair Lending

and Equal Credit Opportunities. However, something was lost between the

enactment of this Act into law, because the CFPB Complaint Process, and

the CFPB Complaint Database are devoid of any mention of racial,

ethnicity, gender, or religious discrimination. The only demographic-type

information contained in the CFPB Complaint Database is: older

Americans, servicemembers, and older servicemembers; but it is unclear

it this information was included in the complaints sent to Companies.

Click

HERE

to review the CFPB Credit Discrimination Policies. (This document can

also be found online under the heading:

Addressing credit discrimination at:

https://www.consumerfinance.gov/about-us/blog/addressing-credit-discrimination/.)

Discrimination, in particular, racial

discrimination continues to be one of the greatest problems in

America; yet none of the ninety-six ISSUES included within the

CFPB complaint process, are for the multitude discriminatory

practices that exist within today’s US financial services

industry. CFPB was formed by the Dodd-Frank Wall Street Reform

and Consumer Protection Act of 2011; which was intended to

ensure that the American consumer had a mechanism for seeking

arbitration and mediation of their financially-related

complaints against predatory, fraudulent, and frequently

criminal practices of unfettered financial services

institutions, unregulated non-banks, regulated national

regional, and unregulated state and local banks. The following

seven points from the CFPB-own Credit Discrimination Guidelines,

makes it clear that this Act intended to provide a level

financial playing field for all American consumers, regardless

of race, ethnicity, gender, and religion.

-

Review lenders’ policies, procedures, and lending activity to detect

and address potential discriminatory practices.

-

Bring enforcement actions to stop discriminatory practices and

remedy harm to consumers.

-

Develop new policies, including rules about loan data collection

required by Congress. These data will help ensure that lenders make

credit available in a fair and non-discriminatory manner.

-

Partner with private industry and fair lending, civil rights,

consumer, and community advocates to promote fair lending compliance

and education.

-

Help ensure that consumers have the tools they need to make sound

financial decisions and protect themselves from discriminatory

practices.

-

Assist in reviewing consumer complaints of unlawful discrimination.

We can also review complaint patterns for early warnings about

troubling lending practices. This data will help us in our

supervision, enforcement, rule writing, and education efforts.

-

Conduct research and analysis on equitable access to credit. This

will include analyzing data collected under Federal regulations.

-

Work with the Department of Justice, Department of Housing and Urban

Development, Federal Trade Commission, and other federal and state

agencies to make sure that our fair lending enforcement efforts are

consistent, efficient, and effective.

However, it appears that something was lost

during the translation of the credit discriminatory policies listed

above, and the actual implementation of the CFPB Consumer Complaint

Process, because nothing in the more than seven hundred and forty-three

thousand CFPB complaints included in the CFPB Database, can be

specifically-associated with racial, ethnic, gender, or religious

discrimination. Additionally, during the six years that CFPB has

existed, none of the twenty thousand plus consumer complaints that have

been referred to other federal, state and local agencies, none have been

referred to the CFPB’s Office of Civil Rights, or the Civil Rights

Office within the Department of Justice.

"No Discrimination-Related Issues, or Sub-Issues, are

included in the Current CFPB Complaint Process!"

It is highly-probable that during the past six-plus years,

consumers have attempted to file thousands (and possibly tens of

thousands) of complaints via CFPB, alleging some form of racial,

ethnic, gender, or religious discrimination; however, because

there are no discrimination-related "Issues or Sub-Issues"

within the CFPB Complaint Process, the only way these

discrimination-related claims can be sent to "the Company", is

in appended text-based narratives. (Given "the

Company is A Right" biases ingrained in the CFPB Complaint

Process, the Company is only required to respond to the Issues

and Sub-Issues of the complaint; and thus, there are no

motivations for "the Company" to respond to appended consumer

complaint narratives.)

Click

HERE

to see a summary of all Issues and Sub-Issues in consumer

complaints from January 2011 through April 2017.

Also, click

HERE to see a printable list of ninety-five Issues that are

included in the CFPB Complaint Process.

Read more regarding why "The

CompanyAlways Wins"!

|