Assessment of THE "FLAWED" CFPB Complaint Process

and cfpb database,

including Analysis of "thirty-five" process and

architecture flaws.

As the five tables in the following section will show, the

consumer protection portion of the 2011 Dodd-Frank Act has been

a disaster, and although the consumer protection agency created

by this act, claims success, after success, after success, ... ;

the CFPB would be hard press to prove that they have "protected"

the American consumers from the predatory Wall Street financial

services titans. In fact, as the following three tables are for

the twenty Companies to which the largest number of CFPB

complaint have been filed during the past six-plus years. More

than sixty-two percent of all CFPB consumer complaints were

filed against twenty companies. These companies, which are

hereafter referred to as "The Top-20" appeared to have

discovered the flaws in the CFPB Complaint Process that allows

"the Company rather than the Consumer" to benefit from the

complaint process. These tables show the number of CFPB

complaint filed by Company; and how these Top-20 Companies

responded to consumers, and the public, respectively.

The following assessment of consumer complaint filed against the

Top-20 Companies between January 2011 and March 2017, is an

accurate barometer of the effectiveness, or lack thereof, of the

CFPB Complaint Process. Companies in the Top-20, received

477,400 (64.21%) of the Total 743,427 CFPB Complaints filed

against 4,168 who received at least one consumer complaints

during this period.

Top-20 CFPB Consumer

Complaints by Company

(w/2015 versus 2016 Complaint Comparisions.)

Source: CFPB Public

Consumer Complaint Database |

|

Rank |

Company Name |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

Total |

2016 vs. 2015 |

|

1 |

Bank of America |

583 |

16049 |

16459 |

10287 |

9833 |

9783 |

1934 |

64928 |

99.49% |

|

2 |

Wells Fargo & Company |

258 |

9452 |

11127 |

9168 |

9282 |

11205 |

2089 |

52581 |

120.72% |

|

3 |

Equifax |

|

621 |

4775 |

9963 |

12003 |

15971 |

3288 |

46621 |

133.06% |

|

4 |

Experian |

|

725 |

5273 |

10246 |

10828 |

13947 |

2904 |

43923 |

128.80% |

|

5 |

JPMorgan Chase & Co. |

374 |

7289 |

7990 |

7735 |

7968 |

8762 |

1683 |

41801 |

109.96% |

|

6 |

TransUnion

Intermediate Holdings, Inc. |

|

464 |

3561 |

8040 |

10167 |

12983 |

2951 |

38166 |

127.70% |

|

7 |

Citibank |

306 |

5433 |

5878 |

5768 |

6202 |

8703 |

1642 |

33932 |

140.33% |

|

8 |

Ocwen |

54 |

3762 |

4813 |

6272 |

4906 |

3489 |

517 |

23813 |

71.12% |

|

9 |

Capital One |

246 |

3877 |

3328 |

3343 |

3690 |

4259 |

969 |

19712 |

115.42% |

|

10 |

Navient Solutions,

LLC. |

|

1209 |

1586 |

2434 |

2102 |

3308 |

5830 |

16469 |

157.37% |

|

11 |

Nationstar Mortgage |

3 |

949 |

3089 |

4116 |

4039 |

3189 |

549 |

15934 |

78.96% |

|

12 |

Synchrony Financial |

86 |

1470 |

1592 |

2743 |

2885 |

3052 |

753 |

12581 |

105.79% |

|

13 |

U.S. Bancorp |

66 |

1527 |

2029 |

2533 |

2707 |

2618 |

595 |

12075 |

96.71% |

|

14 |

Ditech Financial LLC |

1 |

829 |

2054 |

2428 |

2693 |

2797 |

445 |

11247 |

103.86% |

|

15 |

PNC Bank N.A. |

34 |

1398 |

1636 |

1833 |

1594 |

1663 |

328 |

8486 |

104.33% |

|

16 |

Amex |

61 |

939 |

1113 |

1385 |

1684 |

2374 |

516 |

8072 |

140.97% |

|

17 |

Encore Capital Group |

|

|

984 |

2596 |

2173 |

1559 |

329 |

7641 |

71.74% |

|

18 |

HSBC North America

Holdings Inc. |

40 |

1239 |

1628 |

1652 |

1302 |

1057 |

184 |

7102 |

81.18% |

|

19 |

Discover |

57 |

843 |

901 |

1015 |

1477 |

1589 |

370 |

6252 |

107.58% |

|

20 |

SunTrust Banks, Inc. |

48 |

1099 |

1125 |

1060 |

1162 |

1325 |

245 |

6064 |

114.03% |

|

Top-20 Annual Totals |

2217 |

59174 |

80941 |

94617 |

98697 |

113633 |

28121 |

477400 |

96.37% |

|

Assessment of

Top-20 Companies: CFPB Fails to Review and Monitor its

Complaint Database for Trends, Patterns, and

aberrations, thus between January 2011 and March 2017,

more than Sixty-Two Percent of all Consumer complaints

were Filed against the above Top-20 Companies.

Example: Consumer complaints received from fourteen of

the Top-20 Companies increased between 2015, and 2016;

and seven of these Companies had more than 20% more

consumer complaint than in 2016 than they did in 2005.

|

Top-20 Company's

Responses to Consumers.

(10:1 Ratio: Red - Complaints

"Closed with explanation"

vs. Green - Complaints "Closed with monetary

relief".)

Source: CFPB Public

Consumer Complaint Database. |

|

Public Response to Consumer |

Year Consumer Complaint Filed by CFPB |

Total Complaints |

Percent Complaints |

| 2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

Closed |

1 |

1080 |

1382 |

972 |

1184 |

808 |

87 |

5514 |

1.16% |

|

Closed with explanation |

11 |

29396 |

61899 |

72328 |

76324 |

87748 |

20777 |

348483 |

73.00% |

|

Closed with monetary relief |

1 |

4966 |

6453 |

6467 |

6756 |

8254 |

1583 |

34480 |

7.22% |

|

Closed with non-monetary relief |

2 |

5970 |

11200 |

14850 |

14433 |

16786 |

3036 |

66277 |

13.88% |

|

Closed with relief |

541 |

3665 |

|

|

|

|

|

4206 |

0.88% |

|

Closed without relief |

1628 |

13863 |

|

|

|

|

|

15491 |

3.24% |

|

In progress |

|

|

|

|

|

7 |

2557 |

2564 |

0.54% |

|

Untimely response |

33 |

234 |

7 |

|

|

30 |

81 |

385 |

0.08% |

|

Total Complaints |

2217 |

59174 |

80941 |

94617 |

98697 |

113633 |

28121 |

477400 |

100.00% |

|

Assessment of Top-20 Companies:

The Number of Consumer Complaints "Closed with

Explanation" was more than ten times the

number "Closed with Monetary

Relief".

Example of the Failure of the

CFPB Complaint Process

The percentage of consumer complaints "Closed

with Monetary Relief" decreased from

16.91% in 2012 down to 9.91% in 2016.

|

Top-20 Company's "Closed

with Explanation"

Responses.

(Red: Company Responses to Complaints, not

Shared Publicly.)

Source: CFPB Public

Consumer Complaint |

|

Public Response to Consumer |

Year Consumer Complaint Filed by CFPB |

Total Complaints |

Percent Complaints |

| 2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

Company believes complaint caused principally by

actions of third party outside the control or

direction of the company. |

|

|

|

1 |

49 |

21 |

3 |

74 |

0.02% |

|

Company believes complaint is the result of an

isolated error. |

|

|

|

|

84 |

379 |

48 |

511 |

0.15% |

|

Company believes complaint relates to a

discontinued policy or procedure. |

|

|

|

|

5 |

3 |

|

8 |

0.00% |

|

Company believes complaint represents an

opportunity for improvement to better serve

consumers. |

|

|

|

|

15 |

112 |

30 |

157 |

0.05% |

|

Company believes it acted appropriately as

authorized by contract or law. |

|

|

|

4 |

1012 |

1934 |

231 |

3181 |

0.91% |

|

Company believes the complaint is the result of

a misunderstanding. |

|

|

|

1 |

46 |

334 |

52 |

433 |

0.12% |

|

Company can't verify or dispute the facts in the

complaint. |

|

|

|

|

19 |

12 |

2 |

33 |

0.01% |

|

Company chooses not to provide a public

response. |

|

|

|

39 |

25452 |

4028 |

|

29519 |

8.47% |

|

Company disputes the facts presented in the

complaint. |

|

|

|

|

22 |

2 |

|

24 |

0.01% |

|

Company has responded to the consumer and the

CFPB and chooses not to provide a public

response. |

|

|

|

3 |

9 |

38952 |

8023 |

46987 |

13.48% |

|

(blank) |

11 |

29396 |

61899 |

72280 |

49611 |

41971 |

12388 |

267556 |

76.78% |

|

Total Complaints |

11 |

29396 |

61899 |

72328 |

76324 |

87748 |

20777 |

348483 |

100.00% |

|

Assessment of Top-20 Companies:

The lack of Public Responses from the Company

virtually-cripples the CFPB Complaint Process because

consumers and other consumer complaint agencies have no

awareness of how previous complaint by other .

Example of the

Failure of the CFPB Complaint Process:

More than ninety-eight percent of the complaint

responses from Companies were either blank or were not

shared publicly. This practically-eliminates all

capabilities of both consumers, and other consumer

complaint agencies, to view a Company's responses to

similar CFPB Consumer Complaints.

(The only aberration in the above table is that less

than one percent of the consumer complaints filed

against the Top-20, received the Company's response:

"Company disputes the facts presented in the complaint".

It is inconceivable, that in essence, the Company is

stating that the facts presented by the consumer were

not disputed 99.99% of the time; however, only 6.67% of

all consumer complaints were "Closed

with Monetary Relief".)

|

Top-20 Company Responses -

Disputed by Consumers.

(Disputes were Submitted via the CFPB Consumers

Complaint Process.)

Source: CFPB Public

Consumer Complaint Database |

|

Public Response to Consumer |

Year Consumer Complaint Filed by CFPB |

Total Complaints |

Percent Complaints |

| 2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

Closed |

1 |

230 |

327 |

195 |

302 |

182 |

16 |

1253 |

1.33% |

|

Closed with explanation |

3 |

7430 |

14342 |

16123 |

17484 |

17839 |

3527 |

76748 |

81.36% |

|

Closed with monetary relief |

1 |

507 |

733 |

707 |

810 |

841 |

156 |

3755 |

3.98% |

|

Closed with non-monetary relief |

|

1085 |

1808 |

1607 |

1582 |

1464 |

241 |

7787 |

8.25% |

|

Closed with relief |

59 |

513 |

|

|

|

|

|

572 |

0.61% |

|

Closed without relief |

447 |

3774 |

|

|

|

|

|

4221 |

4.47% |

|

Untimely response |

|

1 |

|

|

|

|

|

1 |

0.00% |

|

Total Complaints |

511 |

13540 |

17210 |

18632 |

20178 |

20326 |

3940 |

94337 |

100.00% |

|

Assessment of Top-20 Companies:

94,337 of the total 145,150 consumer complaint disputes

filed with the CFPB, were for complaint responses

received from the Top-20.

Example of the Failure of

the CFPB Complaint Process:

76,748 (81.36%) of disputes for Top-20 Company responses

were for complaints "Closed

with Explanation"; and contrarily, only

3755 (3.98%) of complaint disputes filed with CFPB

against consumer complaints "Closed

with monetary relief" by Top-20

Companies.

Special Note: In

April 2017, CFPB admitted that the option to dispute

Company responses was not part of the Consumer Complaint

Process.

|

Top-20 Company - Disputed

Responses of Referred Complaints.

(Complaints were Referred to CFPB by Other

Consumer Complaint Agencies.)

Source: CFPB Public

Consumer Complaint Database |

|

Public Response to Consumer |

Year Consumer Complaint Filed by CFPB |

Total Complaints |

Percent Complaints |

| 2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

Closed |

|

97 |

110 |

29 |

57 |

28 |

|

321 |

2.01% |

|

Closed with explanation |

1 |

2393 |

3337 |

2487 |

2133 |

1890 |

210 |

12451 |

78.14% |

|

Closed with monetary relief |

|

175 |

153 |

114 |

101 |

108 |

24 |

675 |

4.24% |

|

Closed with non-monetary relief |

|

444 |

321 |

138 |

94 |

72 |

9 |

1078 |

6.76% |

|

Closed with relief |

10 |

129 |

|

|

|

|

|

139 |

0.87% |

|

Closed without relief |

85 |

1186 |

|

|

|

|

|

1271 |

7.98% |

|

Total Complaints |

96 |

4424 |

3921 |

2768 |

2385 |

2098 |

243 |

15935 |

100.00% |

|

Assessment of Top-20 Companies:

15,935 of the total 145,150 disputed Company responses

were for Complaints referred to CFPB from other consumer

complaint agencies.

Example

of the Failure of the CFPB Complaint Process:

The fact

that almost eighty percent of Company "Closed with

explanation" responses to complaints referred by other

agencies were disputed, confirms that the CFPB Complaint

Process "Does not Work"! This assessment if proven by

the fact that prior to referring the consumer complaint

to CFPB, referring agencies review and screen complaints

to ensure that they are being referred to the proper

jurisdictional agency, and the fact that the complaint

is being referred, is proof that it is a legitimate

consumer complaint.

(Special Note: In

April 2017, CFPB admitted that the option to dispute

Company responses was not part of the Consumer Complaint

Process.) |

Other

Major Problems Found in Flawed-CFPB Complaint Process

Some of the most glaring problems we found within the CFPB

Complaint Process include:

-

Companies are allowed to arbitrarily close

complaints even though consumers have formally

disputed the Company Response, and in most

instances, their disputes include additional

documentation that further authenticates and/or

strengthen their original complaint. Between 2011

and March 26, 2017, consumers disputed more than one

hundred and forty-five thousand Company responses,

and there are not records in the CFPB Complaint

Database that any of these disputes were ever

reviewed by CFPB Reviewers, before being discarded.

(Click

HERE to see a list of all

consumer complaint disputes by Company, by year.)

-

No formal CFPB review of consumer complaints are performed by

CFPB, before complaints are forwarded to Company.

Additionally, there does not appear to be formal

CFPB reviews of any complaints closed by Companies.

(Heretofore, it was believed by the consumer that

this was the "Dispute Process", but it is now clear

that the term dispute was a misnomer, and the more

than one hundred and thirty-two thousand so-called

disputes filed by consumers were discarded by CFPB.)

-

The Company is allowed to specify whether, or not,

its response to a consumer can be shared publicly;

and by not sharing this information, consumers have

no awareness of similar complaints filed by other

consumers.(More than ninety-three percent of all

Company responses, were not shared publicly. See

table below entitled: "Company Responses Sent to CFPB and Consumers, but not Shared

Publicly",.to

see annual percentages of Company responses not

shared publicly. (Because Companies do not share

their responses to consumer complaints publicly, it

is virtually-impossible for consumer protection

agencies to track and

analyze patterns of potentially-fraudulent and/or criminal behavior.)

-

Complaints referred by other consumer complaint

agencies, do not receive any special treatment, even

though they have already been reviewed before being

referred to CFPB; additionally, it does not appear

that the Company is made aware of the fact that

these complaints were review by another agency

before being referred to CFPB. Finally, when Company

closes the complaint, the response by Company, is

not forwarded to the referring consumer complaint

agency, and if another consumer register the same

complaint, there is no ability of the referring

agency to inform this consumer of the results of the

prior complaint(s).

-

The CFPB Consumer Complaint Database includes

ninety-five issues, which can be used by consumers to

file complaints with more than forty-one hundred

companies; however, all of these issues appear to be

given the same CFPB ranking and/or priority. As this

implies, all of these ninety-five issues are treated

equally, in the CFPB complaint process; for example,

a five-hundred dollar pay-day loan complaint is

treated the same as a five-hundred thousand dollar

home mortgage loan complaint. (Click

HERE

to see

list of all CFPB complaint issues.).

-

Complaints alleging

serious, and possibly felonious, violations of

federal and state laws are apparently handled the

same as all other consumer complaints, and

theoretically, there could be dozens, if not

hundreds, of similar complaints; and CFPB would

never refer any of these alleged criminal activities

to its internal enforcement unit, or to other law

enforcement agencies.(Click

HERE

to view all CFPB Consumer Complaint actions for

these Identity theft, Fraud, and Embezzlement

complaints.)

|

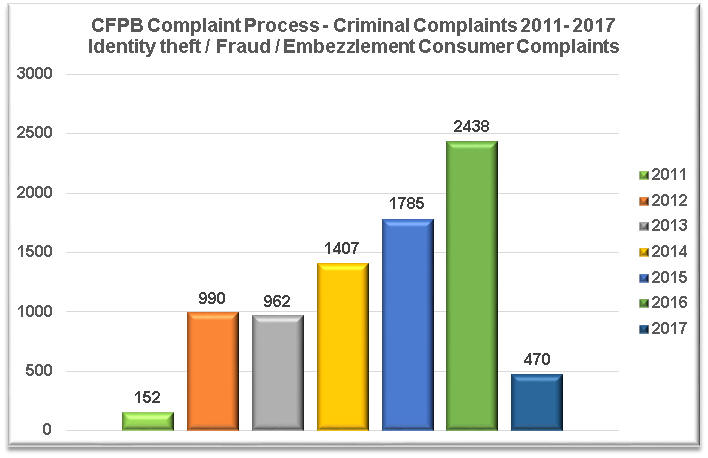

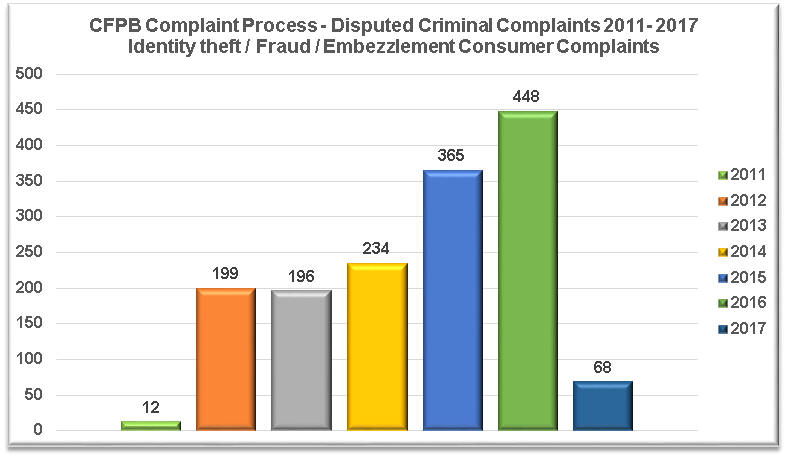

EVEN

POTENTIALLY-SERIOUS, Criminal Complaints,

Received no "Special Handling" by the CURRENT CFPB Complaint Process.

Data obtained

from CFPB under the Freedom of Information Act (FOIA),

shows that only two complaints were referred to this

internal enforcement agency between 2011 and 2017. There

were a total 8,204 of these criminal complaints during

this period; and 1,522 of the Company responses to these

Criminal Complaints were disputed by consumers. Given

the felonious, criminal nature of these, and other

complaints received by CFPB; it is incomprehensible,

that at a minimum, the 1,522 disputed Identity theft,

Fraud, and Embezzlement complaints, were not referred to

either internal investigative departments within CFPB,

or to other federal investigative agencies for further

handling. Issues that require "Special Handling"

include:

- False statements or

representation

- Fraud or scam

- Identity theft / Fraud /

Embezzlement

- Lost or stolen check

- Lost or stolen money order

- Taking/threatening an illegal

action

- Unauthorized transactions/trans.

issues

|

The following charts show the annual

distribution of the aforementioned criminal complaints

filed by consumers, and the consumer's disputes of the

Company responses to these felonious complaints:

|

CONSUMER COMPLAINTS

SENT TO COMPANY BY CFPB

COMPANY RESPONSES

DISPUTED BY CONSUMERS

|

in may 2017, the Bogus,

non-existent Consumer

Complaint Dispute Option, was Finally-Removed from the CFPB

Complaint process and CFPB complaint DATABASE! |

Starting in May 2017, the "façade" of the Complaint

Dispute Option was removed from the CFPB

Complaint Process, and CFPB admitted that the more

than one hundred and forty-five thousand consumer

responses, heretofore known as complaint disputes,

were actually only Consumer Feed-Back reports, and

that the facade of a formal dispute of the Company

response, would be removed from the CFPB website.

More than one hundred and forty-five thousand consumer

complaints were filed with CFPB between 2011 and April

2017, and the acknowledgement of CFPB that there was

never any formal dispute option in the CFPB Complaint

Process, changes the status of these "consumer disputes"

to "consumer feedback". The following chart shows the

annual "disputed" consumer complaints:

|

"IS CFPB

Really STANDING UP FOR the consumer?

As opposed to the following,

which comes directly from the CFPB website home page, the public

domain information contained on the CFPB Complaint Monitor

website will prove that although CFPB has made a measurable

contribution to protecting the American consumer from predatory

lending practices that were pervasive during the past decade, it

has done little to identify the scammer and predatory lenders

that prey on the economically-distressed consumers. The

following four standing up for you claims are impossible to

believe when compared with the fact that 76.7% of all complaints

sent to Companies CFPB were either Closed, or Closed With

Explanation; and only 19.1% were either Closed With Monetary

Relief, or Closed Without Monetary Relief. On the contrary, to

what is shown below, this four-to-one rejection rate by

Companies of consumer complaints proves that "The Customer Is

Not Always Right!"

CFPB "STANDING UP FOR YOU" CLAIMS ARE UNSUBSTAINIATED!

In fact, the consumer

complaints contained in the current CFPB complaint database

raises the following issues:

-

It is unclear how the $11.8 billion in relief,

for 29 million-plus consumers were calculated; but

the CFPB consumer complaint database shows that

between 2011 and

2017, only 49,609 of 743,427 complaints Closed with Monetary Relief accounted for only 6.7%

of all complaints filed by CFPB.

(Click

HERE to see a detail list of

consumer complaints that were Closed with Monetary

Relief.)

-

Additionally, one of these four "Standing up for

you" claims were positively able to refute by the

consumer relief database: this claim of 1.1

million-plus complaints handled by the CFPB

Complaint Process:

As of March 26, 2017, the CFPB Complaint

Database included records for 743,427 consumer

complaints, and the third claim is more than three

hundred and fifty thousand less than that claimed by

CFPB. (Click

HERE to see a list by Company of all

consumer complaints filed via CFPB.

-

In May 2017, CFPB acknowledged that the CFPB Complaint

Process did not include a formal Dispute Option, and that what was

previously known as the Consumer Dispute Option" was actually only

consumer feedback. This gross-misrepresentation of an dispute option,

rather than a optional consumer feedback option; resulted in more than

one-hundred and forty-five thousands meaningless "optional complaint

feedbacks" being submitted by consumers, who at the time, believed they

were disputing the Company responses sent to CFPB.

|

The following chart shows the origin of all complaints found in

the CFPB complaint database:

|

CONSUMER COMPLAINT PROCESS PROVIDES An effective means FOR

sending CONSUMER complaints to COMPANIES; however, it does not

perform any complaint arbitration functions, and does not

intervene on the consumer’s behalf!

The CFPB provides a mechanism for

consumers to submit complaints to Companies, and recording the

responses received by CFPB, and relayed to the consumer.

However, CFPB does not take an active role in the arbitration of

the consumer's complaint, and the Company's response is simply

relayed to the consumer with comments or commentary.

Additionally, now that the bogus consumer dispute option has

formally been removed from the process; the consumer has no

appeal options available, and must retain an attorney to pursue

the complaint any further. As a point of reference, the CFPB

Consumer Database shows that more than seventy-six percent of

all complaints submitted via the CFPB complaint process are

either denied or rejected by the Company, and now that the

dispute process is no longer an option, there are no mechanisms

available for the consumer to appeal/dispute the Company's

response.

Consumer

Complaint Database IS OF LITTLE, OR NO, VALUE TO THE AVERAGE

CONSUMER.

The underpinning of the "CFPB

consumer complaint process", is a database that includes all

consumer complaints filed with CFPB between 2011 and 2017. The

CFPB Database is used to track all consumer complaints from the

time they are submitted by consumers, or referred from other

consumer complaint agencies; until they are closed by the

Company. The CFPB Consumer Complaint Database was officially

placed online on June 1, 2012, but includes more than

twenty-five hundred consumer complaints that was filed with the

bureau in 2011. As of March 26, 2017, this database had more

than seven hundred and forty-three thousand consumer complaints,

and receives more than fifteen thousand consumer complaint per

month. A complete list of the more than forty-one hundred

Companies that have received one or more complaints can be

viewed by clicking

HERE. Additionally, a printable detail

description of all fields in the CFPB Complaint Database can be

viewed by clicking

HERE.

|